stock sell off end of year

Offsetting capital gains may motivate you to sell stocks at the end of a year in which youve seen a gain. If you have capital gains from other investments you have to pay taxes on those gains.

Best Time S Of Day Week And Month To Trade Stocks

Some people sell some of their stocks that have lost money to counteract the gains in other investments.

. For example the companys earnings have deteriorated significantly. So that could mean that lower future earnings are to be. The first half of 2022 marked a big change for investors and consumers as inflation reared its ugly head.

Institutional Investors want to show in their end of year holdings they are picking winners so they tend to sell losers and accumulate stocks that performed well during the year. The end of year sell off is to sell of stocks that people have lost money on. To begin with understand that sell-offs and corrections ie declines of at least 10 from a recent high happen with more frequency than you probably realize.

Below are seven. Ad Join 500k Active Members Who Follow Our Free Penny Stock Picks. A stock that declines 50 must increase 100 to return to its original amount.

For example if you bought SHOP before the Citron story and held youd be selling that off in this instance. We can see it happens almost every year with 92 of the years. This is sometimes known as tax loss harvesting and some brokerages will give advice or.

You may therefore want to get back into the stocks you sold by the end of the year. There are losing stocks out there. Year-end is a good time to engage in planning to save taxes by carefully structuring your capital gains and losses.

Lets consider some possibilities if you have losses to date. The January effect is a seasonal increase in stock prices during the month of January. The recent stock market sell-off hit almost every industry in the market.

Buying is overcoming selling in many stocks this week as positive sentiment grows among investors. The end of year sell off is to sell of stocks that people have lost money on. NEW YORK June 30 Reuters - Wall Street slid into the finish line of a dismal month and quarter on Thursday as a continued.

This is especially if they believe those stocks will continue to go down in value. Savvy investors will often set a target price when they buy a stock. The stock has reached your target price.

Penny Stock Traders Have Made Huge Profits. The last day to sell stocks for a tax loss in 2020 is probably December 28 or 29 if your broker will settle the transaction before December 31. Two main reasons for selling at the end of the year.

Now is the time to move. There are some caveats to all of this. For example suppose you lose money in the stock market in 2016 and have other investment assets that have appreciated in value.

If youre planning to sell assets at a loss to offset gains that have been realized during the year its important to be aware of the wash sale rule. A stock that drops 50 from 10 to 5 5 10 50 must rise by 5 or 100 5. Relative valuation of companies has reached unsustainable levels.

Things get more complicated if youre waiting for a short sale transaction to settle The other rule for. It was no different when sentiment on the US technology exchange turned negative early this year prompting a sell-off. It emerged from the.

This is the figure that they would be happy to sell the stock for. When you sign up youll reveal the names and ticker symbols of these 5 companies. Based on broad industry benchmarks like the CAPE ratio the market reached critical mass in 2021.

For Canada the last day for tax-loss selling in 2021 is December 29. Investors normally dont sell winners at this time to avoid paying taxes on capital gains for the next tax period also tend to sell losers to claim capital loses against their tax bill. 1 day agoB y Stephen Culp.

While a set price may be difficult for even the most experienced investors having a price range in mind gives you a solid enough target. Your Long-Term Investment Goals Are Our Priority. You should consider the extent to which you should sell before the end of.

And investors have turned bearish on the markets ability to fulfill such lofty valuations. Fortinet released its first-quarter 2022 results on May 4 reporting a 34 year-over-year increase in revenue to 955 million. Analysts generally attribute this rally.

Think about it in dollar terms. If the companys fundamentals have changed substantially in a negative way then you should sell away your stocks and cut your loss as soon as possible. It was the worst start of the year.

Ad These 5 companies are set for historic price action. More importantly the companys bookings shot up 50 year over year. Investors normally dont sell winners at this time to avoid paying taxes on capital gains for the next tax period also tend to sell losers to claim capital loses against their tax bill.

How the Rule Works Under this rule if you sell stock or securities for a loss and buy substantially identical stock or securities back within the 30-day period before or after the sale date the loss cant be claimed for tax. Its still a good company and undervalued but for the foreseeable future this tax year its price isnt going up. Also be aware that if you do sell you cant repurchase that stock or a substantially identical investment within 30 days or else you cant take a.

The second opportunity to profit traces to the tendency of stocks sold in December to bounce back in the New Year. The end of year sell off is to sell of stocks that people have lost money on. Ad Connect With Edward Jones And Learn More About The Current Market Fluctuations.

And the big drop in earnings is not caused by a one-off event. Although the SP 500 has gained more than 5 year-to-date it has been a. The key thing for investors to remember is that it has deadlines.

One of the prevailing theories behind the stock market sell-off in 2022 is simply a correction. Your sale of stock at a loss coupled with the repurchase of the same stock within 30 calendar days after the sale would trigger the wash-sale rules disallowing the capital loss. We Make It Easy To Sell Your Private Shares.

What Is Causing The Crypto Sell Off When Will It End Cryptocurrency Bitcoin Price Blockchain

Best Time S Of Day Week And Month To Trade Stocks

Enjoy The Next Chapter Retirement Bookmarks Retirement Etsy How To Make Bookmarks Retirement Gifts Personalized Bookmarks

Little Bighorn Stock Market Investing In Stocks Stocks For Beginners

The Stock Trading Investment Bundle For 21 Expires October 28 2120 06 59 Pst Buy Now And Get 97 Off Stock Tradin Stock Trading Investing Investing Strategy

Pin By Insignia Consultants Karnani On Metals Currencies And Cryptocurrency Reports Short Term Trading Moving Average Hundred Days

U S Global Jets Etf Nysearca Jets Stock Charts Ishares Investing

Forex Broker Online Currency Trading With Superforex Sf In 2022 Trading Charts Stock Trading Strategies Forex Trading Training

Rudra Investment Expert Says Free Nifty Tips Due To Heavy Sell Off In The Information Technology It Sector A Large Drop In The Share Prices Investing Nifty

Psychology Of What Could Happen The Next 4 Year With The Market Stock Market Stock Market Data Marketing Data

Low Stock Alert When They Sell Out They Will Be Back At The End Of November Lowstock Naildash Naildashes Redaspe Lashes Makeup Glue On Nails Red Nails

Pathfinders Trainings Reviews Stock Market Stock Market Courses Stock Market Training

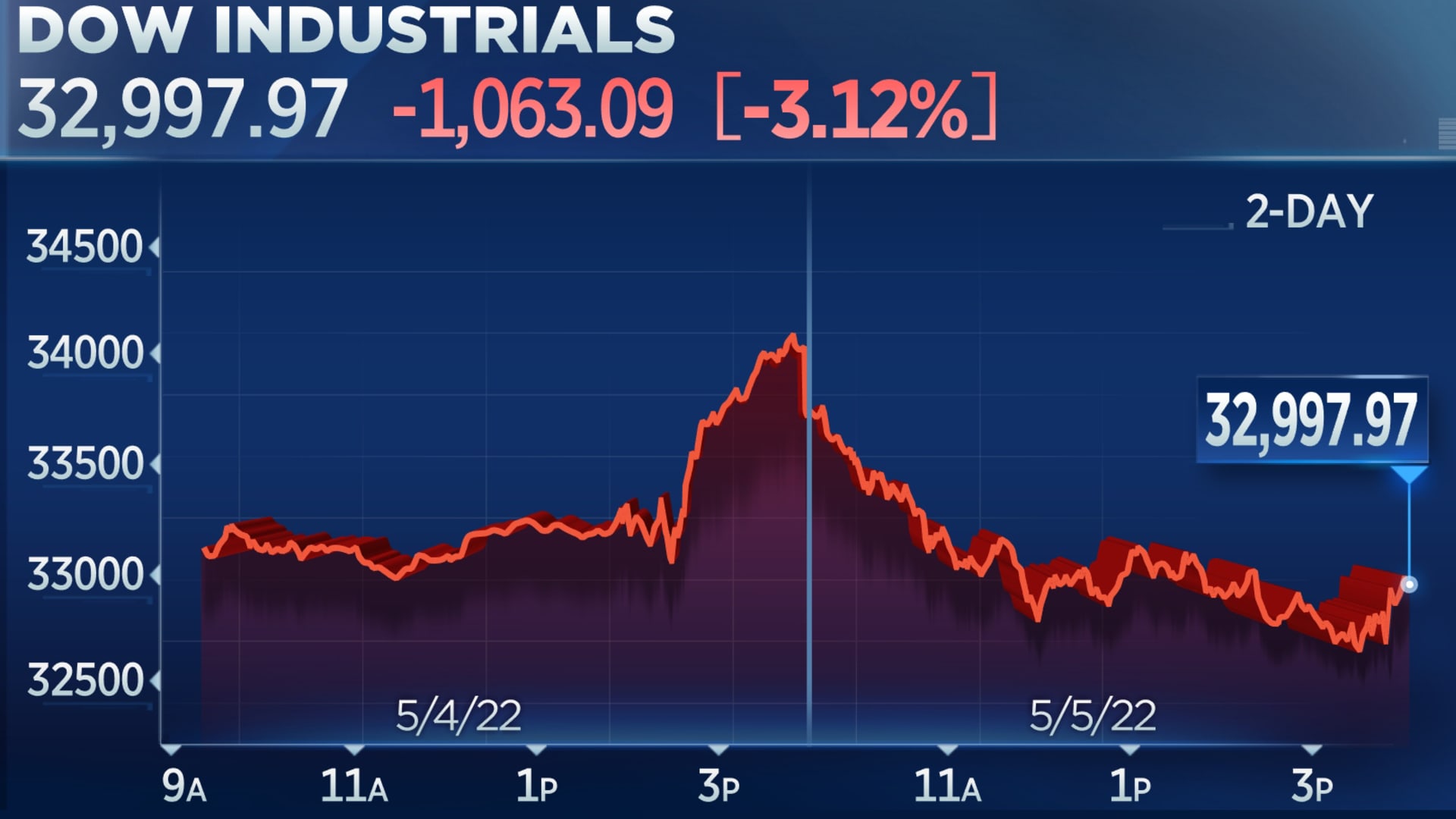

Dow Tumbles 1 000 Points For The Worst Day Since 2020 Nasdaq Drops 5

Treasury Yields Fall Prices Climb As Investors Seek Shelter From Stock Sell Off In 2022 Stock Futures Global Stocks Stock Market

End Of October Sale Going On Don T Miss Out 15 Off All Fall Scrubs No Promo Code Needed Everything Is Handmade Or October Sale Orange Spice Handmade Shop

How To Buy Sell Stocks For Beginners Sapling Finance Investing Investing In Stocks Stocks For Beginners

:max_bytes(150000):strip_icc()/Capitulation12-d3efb4191a234673a04dc23340bb9f7e.png)